Nomadic Matt has partnered with ThePointsGuy.com for our coverage of credit card products. Some or all of the card offers on this page are from advertisers and compensation may impact how and where card products appear on the site. Nomadic Matt and ThePointsGuy.com may receive a commission from card issuers.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. This page does not include all card companies or all available card offers.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

I love talking about travel credit cards. They’ve helped me travel the world for over a decade and saved me a fortune in flights, hotels, and other travel perks. I never get bored of comparing their perks, applying for new cards, and optimizing my benefits.

These days, when it comes to travel rewards cards, there are generally two types that get a lot of attention: cards with low or no annual fees that are good for beginners; and premium cards for the jet set crowd, with their high fees and luxury perks.

There aren’t too many cards that fall in between. Today I want to talk about a card that does: the American Express® Gold Card.

While it’s a favorite among avid points and miles collectors, it often gets left out of the larger conversation. I think that’s a mistake, as this card has a lot to offer.

The Amex Gold recently got a refresh and an elevated welcome offer, making it an excellent time to consider this powerhouse of a card. I personally think it’s a card more travelers should have in their wallet and it is one I use.

Here’s everything you need to know about the Amex Gold to help you decide if it’s right for you:

What is the American Express® Gold Card?

The American Express® Gold Card is a card issued by American Express. I think it’s a great choice for travelers who enjoy dining out, as you’ll earn more points dining at restaurants (up to $50,000 on these purchases per calendar year), as well as a ton of statement credits in the same vein (I’ll get into specifics below).

With this card, you’ll earn Membership Rewards® points, which you can transfer to any of their 21 airline and hotel partners (they have some solid partners too).

This card offers:

- 60,000 points + earn up to $100 back Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Plus, receive 20% back in statement credits on eligible purchases made at restaurants worldwide within the first 6 months of Card Membership, up to $100 back. Limited time offer. Offer ends 11/6/24.

- Earn 4x Membership Rewards points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1x points for the rest of the year

- Earn 4x Membership Rewards points per dollar spent at US supermarkets on up to $25,000 in purchases per calendar year, then 1x points for the rest of the year.

- Earn 3x Membership Rewards points per dollar spent on flights booked directly with airlines or on AmexTravel.com

- Earn 2x Membership Rewards points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com

- Earn 1x Membership Rewards point per dollar spent on all other eligible purchases.

- Up to $524 worth of statement credits (which I’ll break down below)

- No foreign transaction fees

The card comes with a $325 annual fee (See Rates and Fees).

Breaking Down the Amex Gold’s Statement Credits

American Express is known for offering a lot of perks and benefits with its cards (that’s why I love their cards). As I mentioned, this card comes with up to $524 worth of statement credits. If you can take advantage of them, that’s more than enough to offset the annual fee. Since there are so many credits (all with their own fine print), I want to break each one down.

Up to $120 in Uber Cash

This is probably the easiest benefit for most people to use. When you add your Gold Card to the Uber app, you’ll get $10 in Uber Cash distributed each month, (adding up to $120 over the course of the year). You can use it for rides or to order food through Uber Eats, though I don’t love that you can only use it in the U.S. since I’m often on the road.

Before your purchase, make sure that Uber Cash is toggled on as a payment method, and then after your purchase you’ll see the credit deduction on your in-app receipt.

You must have downloaded the latest version of the Uber App and your eligible American Express Gold Card must be a method of payment in your Uber account. The Amex benefit may only be used in United States.

Up to $120 Dining Credit

On the flip side, I find this benefit a bit harder to use. You can earn up to $10 in statement credits monthly when you pay with the Amex Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. I think it’s kind of a random assortment of companies, but if you use any of these companies often, that’s another $120 per year right there.

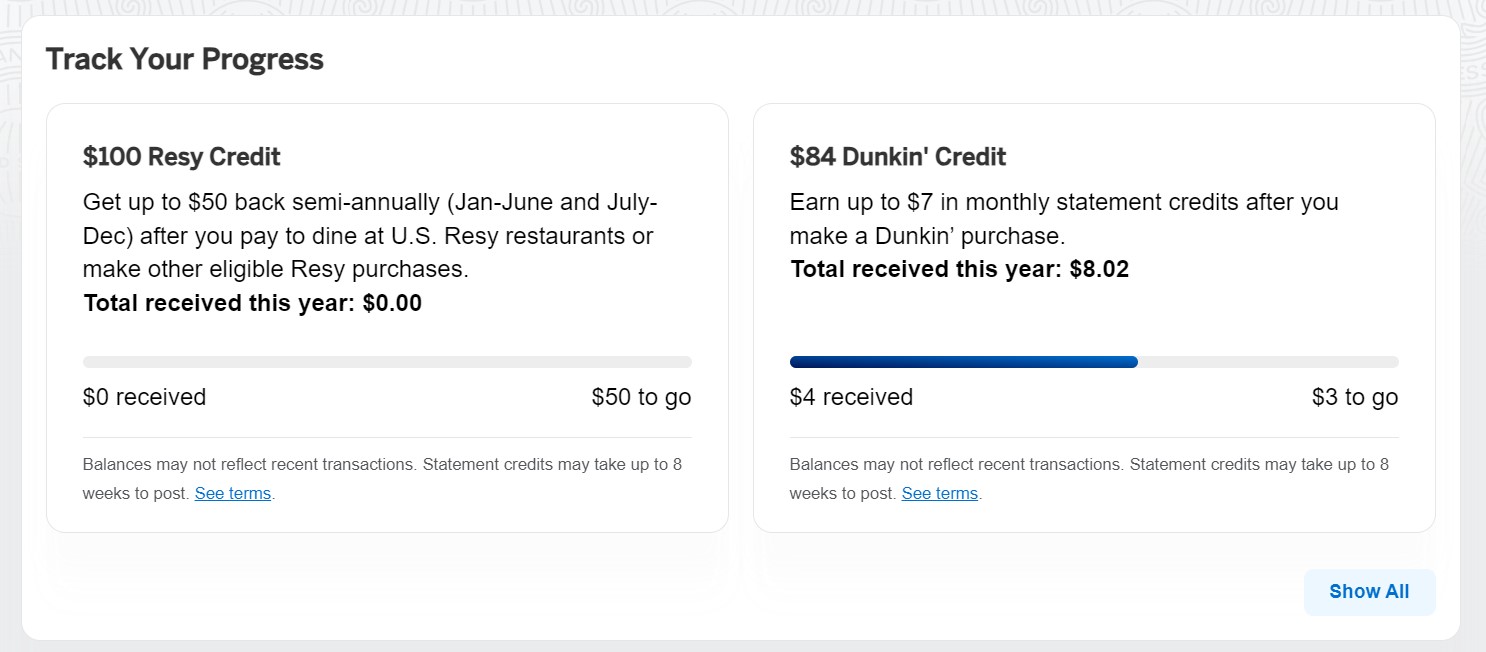

Up to $84 Dunkin’ Credit

This benefit was added with the card’s recent refresh. If you’re a fan of Dunkin’, with this credit you can earn up to $7 in monthly statement credits after you enroll and pay with your Amex Gold Card at Dunkin’ locations. Since most are on the U.S. East Coast (New York, New Jersey, Connecticut, and Florida have the most locations), it’ll be most useful to fellow East Coasters.

Up to $100 Resy Credit

This is another benefit that was recently added. Resy is a restaurant-reservation website (owned by Amex) where you can make reservations at over 16,000 restaurants around the world.

With the Resy credit, you can get up to $100 in statement credits each calendar year after you pay with your Gold Card to dine at U.S. Resy restaurants (or make other eligible Resy purchases). Unlike most of the card’s other statement credits, this benefit is rolled out semi-annually, meaning you get up to $50 credit in the first half of the year, and then the other $50 the second half. You can also check your progress in the app or website:

I like semi-annual statement credits because they give you a bit more flexibility, although this is another credit that’s fairly easy to use if you dine out frequently. You don’t actually have to make a reservation with Resy; the restaurant just needs to offer Resy reservations. It’s easiest if you live in or frequently visit a major city that has a lot of restaurants on Resy.

Up to $100 hotel experience credit

This is the card’s only travel statement credit. With this benefit, you can receive a $100 credit towards eligible charges with every booking of two nights or more through AmexTravel.com. Eligible charges vary by property, but it could include dining credits (like complimentary breakfast) or spa treatments.

Enrollment is required for select benefits mentioned in this section.

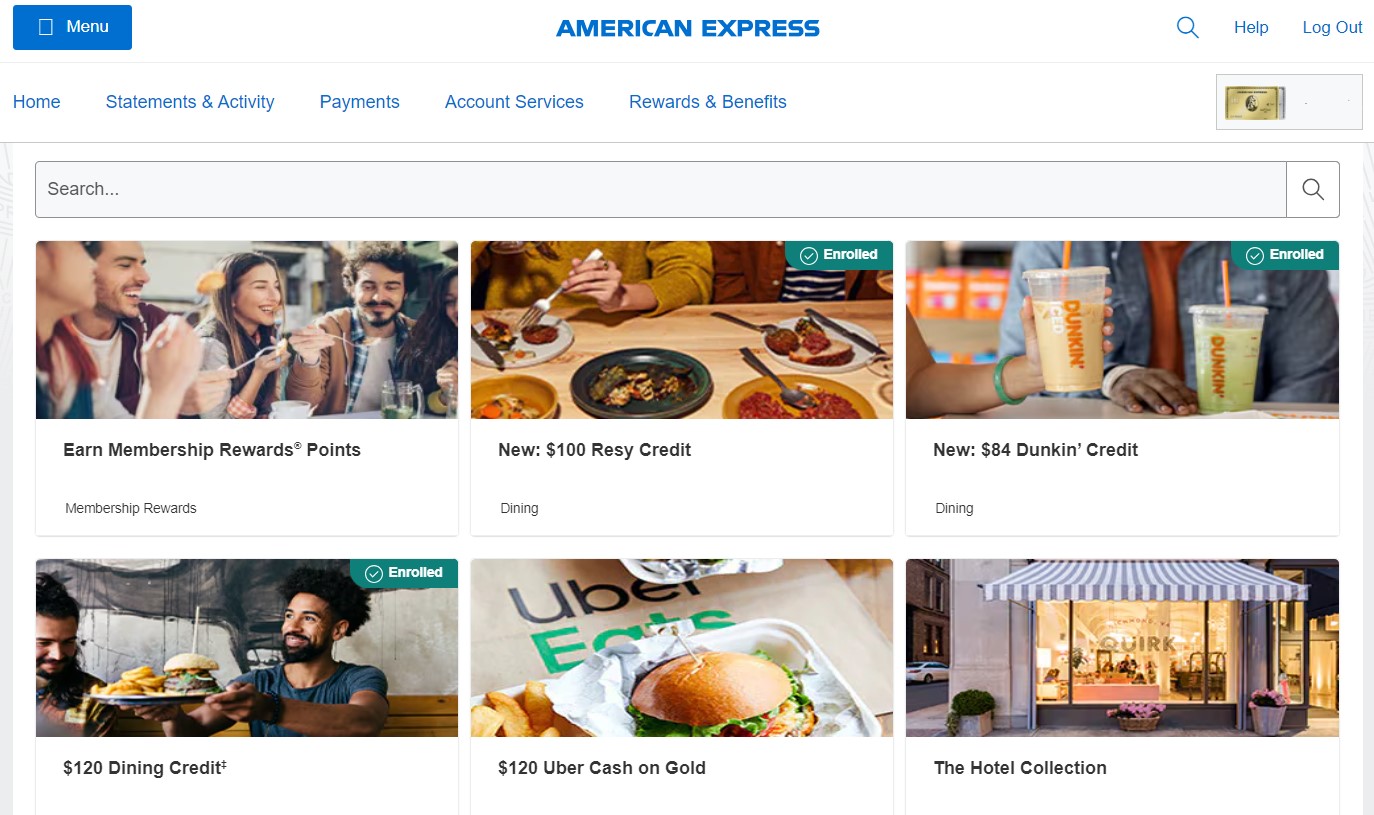

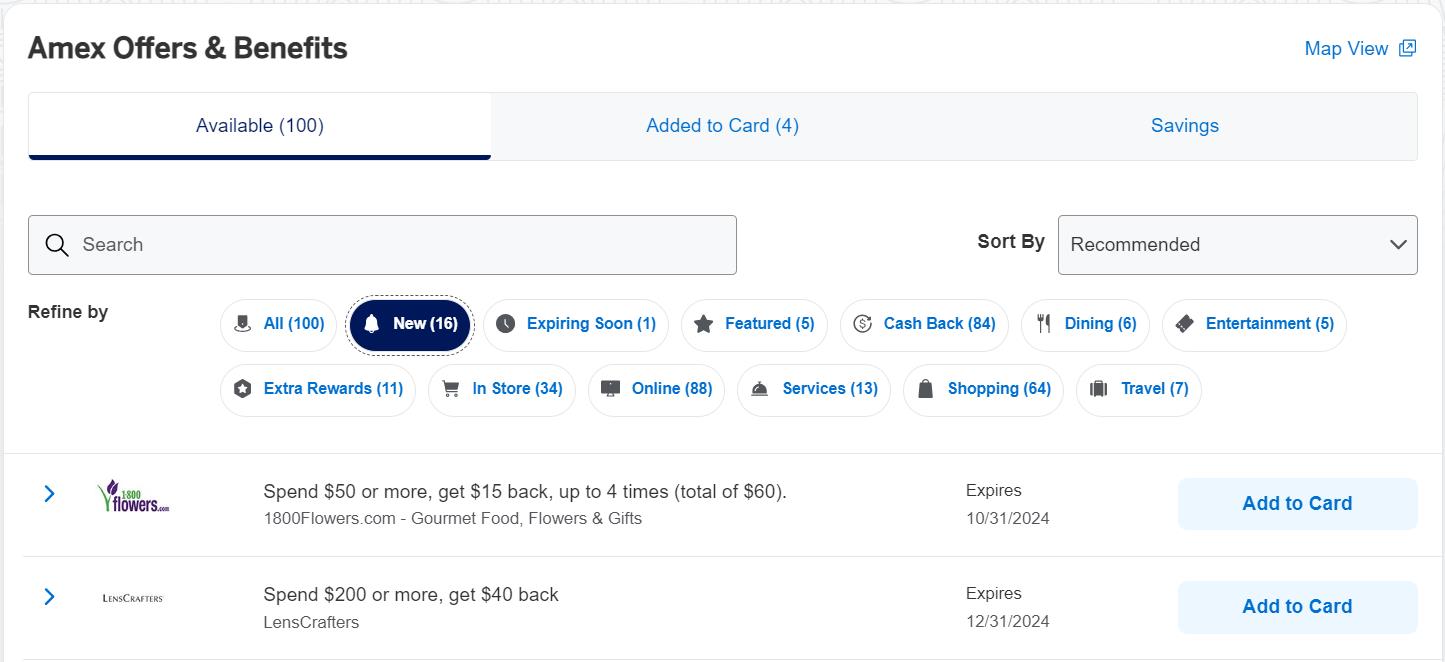

Access to Amex Offers

In addition to all those statement credits, by holding an American Express card you get access to Amex Offers. These are ever-changing offers where you can save money or earn bonus points with select retailers. The offers are targeted, so every cardholder has their own unique array of offers at any given time.

Amex Offers are structured like this:

- Spend X, get Y amount back (like in the screenshot above; this is the majority of Amex Offers)

- Spend X, get Y number of bonus points

- Get additional Membership Rewards points per dollar you spend at that retailer (i.e. get 5 MR points per dollar you spend at The Gap)

- Get X% back when you use the link provided

It’s important to know that you have to hit that “Add to Card” link before you can take advantage of each offer. While you probably won’t be able to take advantage of most offers, sometimes you may, which is another way to recoup the annual fee on this card. It’s worth it to check back every so often so you can add any offers to your card that you might use (just remember to pay with your Gold Card to redeem the offer).

Using Your Membership Rewards Points

With the American Express® Gold Card, you earn Membership Rewards points. To get the most out of your points, you’ll want to transfer them to one of Amex’s travel partners:

- Aer Lingus AerClub (1:1 ratio)

- Aeromexico Rewards (1:1.6 ratio)

- Air Canada Aeroplan (1:1 ratio)

- Air France-KLM Flying Blue (1:1 ratio)

- All Nippon Airways Mileage Club (1:1 ratio)

- Avianca LifeMiles (1:1 ratio)

- British Airways Executive Club (1:1 ratio)

- Cathay Pacific Asia Miles (1:1 ratio)

- Choice Privileges® (1:1 ratio)

- Delta SkyMiles (1:1 ratio)

- Emirates Skywards (1:1 ratio)

- Etihad Guest (1:1 ratio)

- HawaiianMiles (1:1 ratio)

- Hilton Honors (1:2 ratio)

- Iberia Plus (1:1 ratio)

- JetBlue TrueBlue (250:200 ratio)

- Marriott Bonvoy (1:1 ratio)

- Qantas Frequent Flyer (1:1 ratio)

- Singapore KrisFlyer (1:1 ratio)

- Virgin Atlantic Flying Club (1:1 ratio)

Most transfers are instant, though a few (like Iberia and Cathay Pacific) can take up to 48 hours.

You can also use your Membership Rewards points to book flights and hotels in Amex Travel, the travel portal. Though, as I’ve talked about before, this isn’t the best use of your points. I generally wouldn’t do it.

American Express Welcome Bonus Restrictions

Unlike other companies (like Chase), American Express only allows you to earn a welcome bonus once per card. Ever. Plus, you can’t earn a welcome bonus on a card at all if you already have (or have held) a higher tier card in the same family.

For the Amex Gold Card, that means you won’t be able to get the welcome offer if you already have The Platinum Card® from American Express.

I’m mentioning this because it’s important to think about if you want to get other Amex cards eventually. This means that for American Express cards, it’s best to open cards moving up in the food chain, so to speak (so get the Gold Card before the Platinum Card).

Pros of the Amex Gold

- High earning rates at restaurants, US supermarkets, and on flights (when booked directly or through AmexTravel)

- Lots of statement credits

- Access to Amex Offers

Cons of the Amex Gold

Who is the Amex Gold for?

The main draw of this card is being able to earn 4x points on restaurants worldwide and U.S. supermarkets. It stands alone in that aspect among cards with transferable points (the most valuable kind of points). If you are a foodie that can make use of the credits and other perks, then you’ll love this card.

If you’re an avid traveler, this card is best used in conjunction with other cards (rather than as the only card in your wallet). It would pair well with another card that earns 3x on all travel and has more robust travel benefits (such as the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®). Plus, you’ll diversify your rewards into two of the most valuable points currencies: Amex’s Membership Rewards and Chase’s Ultimate Rewards.

As with any credit card, you should not get this card if you’re already carrying a balance or plan to carry a balance. Interest rates for travel credit cards are notoriously high, and this card is no different. The points just aren’t worth it if you’re paying interest each month.

This card is also not for anyone with poor credit, as you need excellent credit to qualify. (If that’s you, check out best credit cards for bad credit so you can start improving your score today.)

If you’re a foodie like me and spend a significant portion of your budget on food, the American Express® Gold Card is a great card to add to your wallet. By racking up more points at restaurants around the world and U.S. supermarkets, you can use the spending that you already do to earn yourself flights and hotel stays around the world. And that’s what it’s all about!

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Find a cheap flight by using Skyscanner. It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation

You can book your hostel with Hostelworld. If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance

Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- SafetyWing (best for everyone)

- InsureMyTrip (for those 70 and over)

- Medjet (for additional evacuation coverage)

Want to Travel for Free?

Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip?

Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Ready to Book Your Trip?

Check out my resource page for the best companies to use when you travel. I list all the ones I use when I travel. They are the best in class and you can’t go wrong using them on your trip.

The post American Express® Gold Card Review appeared first on Nomadic Matt's Travel Site.

https://ift.tt/7fx0AFi September 10, 2024 at 06:05AM

Comments

Post a Comment